Cryptos Fall as Leverage Traders Exit Positions Amid Gold Rally

The market capitalisation of cryptocurrencies decreased by 2.51% to $3.07 trillion within the past 24 hours across various exchanges, as leveraged traders closed their positions during a surge in gold prices.

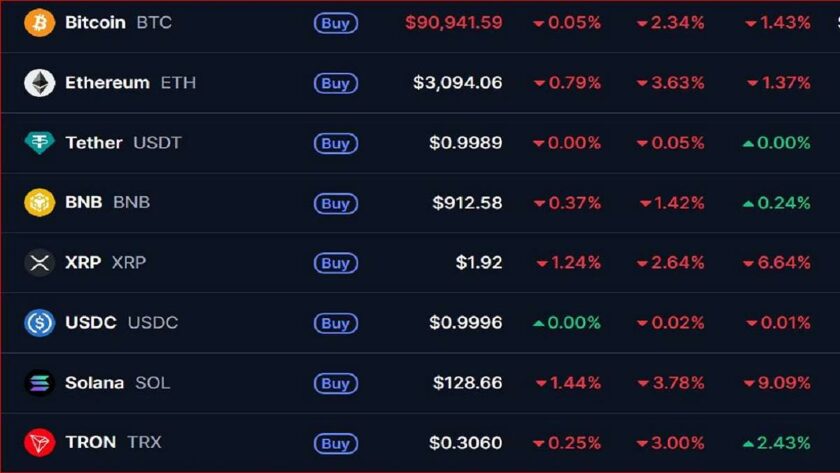

Bitcoin price has plunged to $90k, losing more than 2.2% in the last 24 hours, and Ethereum is down by 3.51%, trading slightly above $3k on Tuesday.

At the same time, other top cryptocurrencies are struggling to keep their position in strong volatile market development amidst U.S. actions that are changing world economic orders with President Donald Trump’s tariff ‘weaponisation’.

Trump’s fixation on taking control of Greenland: the market is reacting with significant dollar sell-offs.

With the weakening dollar index and weak appetite for high-risk investment, investors have started to pull out funds from the crypto space. Hence, the crypto market condition has been pressured by safe-haven demand for gold and derivatives-driven selling.

Crypto derivatives volume jumped 39%, while open interest dropped 4.5%, signalling mass position unwinding. BTC saw $8.1M in liquidations, mostly longs. Leveraged traders exited en masse, amplifying the downturn.

Latest data showed that gold surged to a record $4,701/oz amid geopolitical tensions and trade war fears, drawing capital away from risk assets like crypto.

The 24h crypto-gold correlation hit -0.89, the strongest inverse link in months. Crypto analysts said when gold rallies, crypto often falls as investors seek safety. The market has started to watch for sustained gold strength or easing trade tensions.

Assets like Merlin Chain (MERL) dropped 21% due to token unlocks flooding the market with supply. Analysts said scheduled unlocks can trigger sell-offs when new tokens hit exchanges. Today’s crypto price decline reflects a risk-off shift toward gold, derivative deleveraging, and project-specific supply gluts. XRP Rises Amidst Crypto Selloffs as Ripple Boosts Adoption