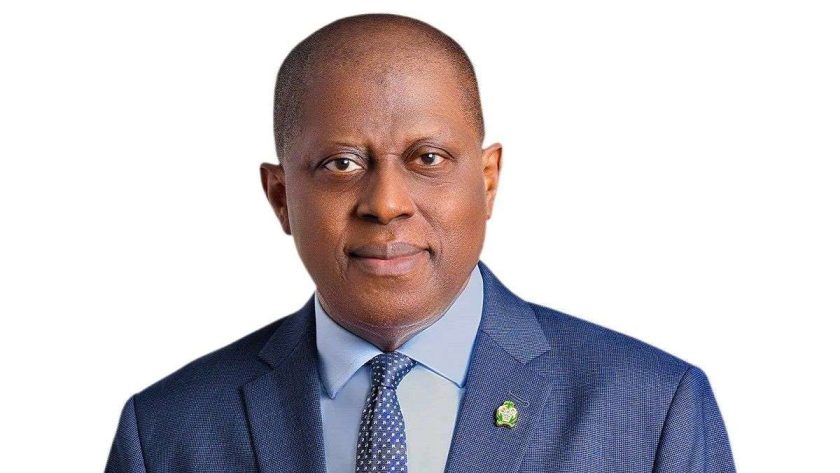

14 Banks Fully Met CBN New Capital Requirement – Cardoso

The Governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, says 14 Nigerian banks have fully met the new capital requirement in the ongoing recapitalisation exercise.

Cardoso said this on Tuesday in Abuja, while presenting a communiqué from the 302nd meeting of Monetary Policy Committee (MPC) of the CBN.

The CBN introduced a new minimum capital base requirement for banks, with tiers depending on licence type. Before then, the last major bank recapitalisation exercise in Nigeria was in 2004, when the CBN raised the minimum capital requirement for all banks from two billion Naira to N25 billion.

This was a significant increase that led to a major consolidation in the banking sector, as the number of banks was reduced from 89 to 25 through a series of mergers and acquisitions.

In the current recapitalisation exercise, commercial banks with international authorisation now have a new capital requirement of N500 billion.

Commercial banks with national authorisation have N200 billion as capital requirement, and commercial banks with regional authorisation have N50 billion.

Merchant banks have a requirement of N50 billion, non-interest banks (national) N20 billion and non-interest banks (regional), N10 billion.

According to Cardoso, members of the MPC acknowledged the significant progress in the ongoing bank recapitalisation exercise, as 14 banks have fully met the new capital requirement.

“They, therefore, urged the CBN to continue the implementation of policies and initiatives that would ensure the successful completion of the ongoing recapitalisation exercise,” he said.

He said that the committee further noted the successful termination of forbearance measures and waivers on single obligors, which has helped to promote transparency, risk management, and long-term financial stability in the banking system.

“The MPC reassured the public that the impact of the removal of forbearance is transitory and does not pose any threat to the soundness and stability of the banking system, price, and other domestic developments.”

Cardoso had earlier announced the decision of the MPC to reduce the Monetary Policy Rate (MPR) by 50 basis points to 27 per cent from 27.50 per cent.

The committee also adjusted the standing facilities corridor around the MPR to +250/- 250 basis points and adjusted the Cash Reserve Ratio (CRR) for commercial banks to 45 per cent from 50 per cent.

It, however, retained the CRR for merchant banks at 16 per cent, while keeping the Liquidity Ratio unchanged at 30 per cent.

According to the CBN governor, the committee Introduced a 75 per cent CRR on non-TSA public sector deposits to enhanceliquidity management.

He said that the committee’s decision to lower the MPR was predicated on the sustained disinflation recorded in the past five months.

He said that the decision was also informed by projections of declining inflation for the rest of 2025, and the need to support economic recovery efforts. #Fidelity Bank Shareholders Wealth Rises by 125% Ahead of Next Capital Raise