Oil Crash: Low FCY Exposure Shields Nigerian Banks from Pressure

Oil sector ranks high among three sectors that raise Nigerian banking sector non-performing loans in the first half of 2020, analysts have noted.

Fortunately, Nigerian banks had shed off significant chunk of foreign currencies exposures before the recent oil crash.

Amidst FX scarcity, analysts said low dollarised loans helped lender’s balance sheet position compare with what happened in 2006/2007 when oil price crashed.

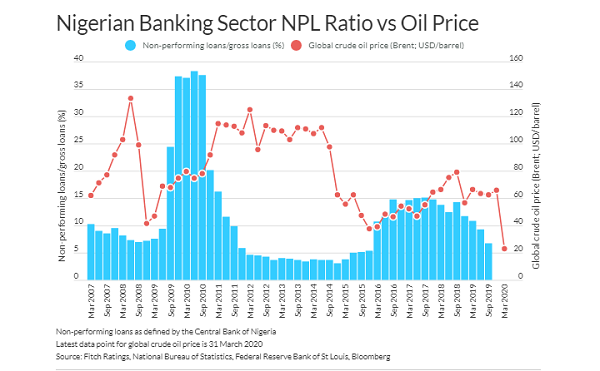

Oil price crash of 2006/07 had raised balance sheet risk among Nigerian banks with exposures plus the need to devalued naira which then spiked the industry NPL to more than 15%.

Despite covid-19 induced pressure, banks assets remain strong on a scale with non-performing loan at single digit.

Vetiva Capital in research note said with all banks’ H1 results finally released, the firm sought to ascertain the net effect of the economic slump on the performance of banks within its coverage.

MarketForces reported that the Nigerian economy contracted 6.1% year on year in the second quarter of 2020 due to lockdown in major cities in the country.

However, unlike other countries that imposed full-scale lockdowns, economic activity was not completely halted.

Vetiva Capital stated that this meant that, although a large section of the economy was effectively closed for much of the quarter, economic activities- and by extension banking activities- continued in some form.

The investment firm however recognised that second quarter loan book growth in the banking sector belies drop in interest income.

As a result of the shutdown, Vetiva said many businesses were unable to carry out activities to generate income; this meant an increase in default risk on loans given out by banks amid the minimum loan to deposit (LDR) regulation set by the CBN.

This saw total loans expanded by 5.7% quarter on quarter in the fourth quarter of 2019 and 5.7% quarter on quarter again in the first quarter of 2020 to ₦18.56 trillion.

“Interestingly, gross loans continued to grow in the second quarter of 2020, most likely as a result of the measures put in place by banks to expand their loan books in the wake of the CBN’s policy”, Vetiva noted.

Data however revealed that industry loan book grew by 1.8% in the second quarter to ₦18.90 trillion, bringing total loan book growth to +7.6% year to date.

Despite this, analyst said there was an average decline in net interest income across Vetiva’s coverage, even accounting for the slump in interest expenses brought about by the current yield environment which masked severity of the drop.

Net interest margins (NIMs) worsened by 7.4% on average across our coverage banks, said Vetiva Capital with worst hit among them being Zenith bank which dropped 2.6% quarter on quarter, Access and UBA declined 1% respectively.

“Looking forward however, we expect to see an improvement in banks NIMs in the second half of 2020, brought about by the CBN’s new policy on interest rates for savings accounts”, Vetiva stated.

Analysts noted that new policy stated that banks are to offer minimum of 10% of monetary policy rate (12.5%) as interest on savings accounts.

This is a reduction from the previous minimum of 3.5%.

“In our view, this should favour banks with high current and savings accounts ratio, four banks within our coverage having ratio above 75%”, Vetiva revealed.

GTBank CASA ratio printed at 86.7% in the first half of 2020, Stanbic IBTC 80.4%, UBA 78.5% and FCMB 77.3%.

“We foresee further moderation in interest expense by financial year 2020”, analysts at Vetiva stated.

Is the worst over for provisions, or is there more to come?

Vetiva explained that among its coverage banks, loan loss provisions went up 115% quarter on quarter, with two banks bearing the brunt of the effect in nominal terms- ZENITHBANK and FBNH both reported provisions of ₦20 billion in Q2 alone.

The investment stated that even banks with historically low provisions reported extraordinary surge quarter on quarter in the period due to the outbreak of coronavirus pandemic.

Specifically, Vetiva mentioned that Guaranty Trust Bank loan loss provision jerked up 353% quarter on quarter in Q2 to (₦5.5 billion) and STANBIC provision rose 126% to ₦4.4 billion in the same period.

However, analyst said this surge in provisions was actually not the worst case scenario, thanks to the approval of the CBN for the restructuring of about 40% of industry loan book (about ₦7.5 trillion) which meant that a large proportion of Stage 2 (Doubtful) loans were given new repayment tenures or different interest charges to ensure continued payment.

Read Also: Nigeria’s Economy Expands 1.87% Despite Global Disruptions

“Without this, industry provisioning would have likely been almost double the current figure.

“Thanks to this strategy, we do not expect provisions to worsen significantly in the second half of 2020, as the economy continues to open up and business activities resume”, Vetiva said in the note.

The investment banking firm however reiterated that it maintains financial year 2020 NPL forecast.

Predictably, analysts said NPL grew 14.4% year to date to N1.19 trillion, which was a 40 basis points worsening of the ratio at 6.4%.

However, as a result of the aforementioned policies, banks were able to delay reclassification of some Stage 2 loans into Stage 3 (non-performing).

On a sectorial basis, Vetiva explained that Oil and Gas (22%), general commerce (14.2%) and Construction (13.8%) contained about 50% of total NPLs.

“Among our coverage banks, we actually witnessed a slight improvement in average NPLs from 5.5% as of financial year 2019 to 5.4% as of second quarter of 2020”, Vetiva analysts stated.

The firm stressed that this is understandable as the majority of loans that were restructure were from banks within Vetiva’s coverage.

“We noticed a difference between this oil price crash and that of 2016/17 which saw industry’s NPLs as high as 15.1%, this was due to the fact that a larger proportion of loans were foreign currency denominated, leading to a higher impairment when oil prices crashed and currency was devalued”, Vetiva recalled.

The firm however explained that this time, the banks have shed most of their foreign currency loans (FBNH still has some on its books) which has helped the banks to avoid recording revaluation related impairments, whilst the scarcity of US dollar has not affected asset quality as badly as 2016/2017.

“Looking forward, we do not expect a significant worsening of either industry NPL or coverage NPL due to the expected recovery in economic activities, rebound in crude prices and restructuring”, Vetiva explained.

Oil Crash: Low FCY Exposure Shields Nigerian Banks from Pressure