Supply Cut: OPEC Records 82% Compliance, EIA Sees Uptick in Brent Price

Nova Merchant Bank Limited has noted that the Organisation for Petroleum Exporting Countries (OPEC+) oil supply cut could be deeper for longer, the view taken as a result of recent developments.

According to the firm, it stated that the Oil cartel records 82% compliance in May, 2020 despite members’ avowed support for production cut.

Meanwhile, Energy Information Administration (EIA) forecasts Brent crude oil price will increase from the lows of Q2 to average $37/barrel in Q3 and $38/barrel in Q4.

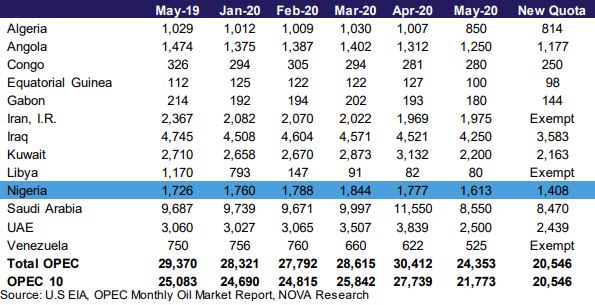

In the first month of the Phase 1 OPEC+ output cut deal, the production by 10 OPEC members in the accord fell by 5.96 million barrels per day (mbpd) in May to 21.8 mbpd.

This was against 27.7 mbpd in April, according to Nova Merchant Bank Limited.

NOVA explained that despite the significant cut in production, the cartel’s output fell short of the agreed cap of 20.55 mbpd due to compliance breaches by some members.

NOVA stated that while Saudi Arabia, UAE, Kuwait and Equatorial Guinea achieved over 90% compliance rate, Iraq, Nigeria, Angola and Algeria had compliance shortfalls of 62%, 49%, 21% and 15% respectively.

Overall, compared to the expected cut of 6.14 mbpd, the cartel only achieved 4.91 mbpd when contrasted with the baseline production of 26.68 mbpd, with estimated compliance rate of 80%, it added.

Excluding the OPEC 10, production in Venezuela and Iran remain constrained by US sanctions, while the blockade of export terminals in Libya has kept output below 100 kbpd.

Oil Prices Revised Higher:

Notwithstanding the shift in market balance in June, NOVA remarked that the massive surplus of 21.5 mbpd in April will push Q2 surplus to average 8.8 mbpd, with a switch to deficit of 3 mbpd in Q3 and a deficit of 3.1 mbpd in Q4.

EIA forecasts Brent crude oil will increase from the lows of Q2 to average $37/barrel in Q3 and $38/barrel in Q4, with average of $38/barrel over 2020 compared to average of $64.4/barrel in 2019.

NOVA said while EIA did not factor the extension of OPEC+ until July into forecast production, it made the adjustment.

The adjustment suggests upside potential for prices compared to estimate.

Also, analysts believe the gradual opening of key economies and minimal infection rate across could result in a rebound in oil demand with further upside potential for prices.

However, an escalation of Covid-19 beyond Q2 could further worsen the outlook for crude oil demand and a free-fall in prices, it stated.

“Another downside risk for us is the resumption of production in Libya and Venezuela, which could add additional 1.7 mbpd to current output”, NOVA said.

For the OPEC+ allies, Russia (the key partner), kicked off the new deal with just 5% compliance shortfall.

Compared to its planned production cut of 2.53 mbpd, Russia delivered a cut of 2.41 mbpd to 8.59 mbpd in May.

Nigeria Fails to Comply With Oil Production Cut

Beyond Russia, Mexico and Oman achieved compliance rates of 93% and 100% respectively, while Kazakhstan, Azerbaijan and other smaller producers fell short of the compliance rate.

In all, compared to the planned Phase 1 OPEC+ production cut of 9.7 mbpd, the group only achieved 8.03 mbpd in May.

At its meeting over the weekend, the group agreed to extend the phase 1 deal until the end of July 2020.

Members who fell short of the agreed output cut will have to compensate with lower production post the phase 1 deal.

Rebound in Demand Pushed Prices Across $40/barrel:

NOVA explained that beyond the cut back in production by OPEC and allies, coordinated cut back occasioned by lower prices resulted in additional production decline of 3.04 mbpd.

U.S. and Canada had a combined production decline of 1.64 mbpd, which added to the OPEC cut resulted in total supply contraction by 11.1 mbpd to 89.6 mbpd in May.

On the other hand, reflecting the partial reopening of some economies and industrial activities, crude oil consumption increased by 3.7 mbpd in May to 82.87 mbpd.

This left the market with a net surplus of 6.7 mbpd compared to April surplus of 21.5 mbpd.

Accordingly, Brent crude spot prices averaged $32.7/barrel in May, up $5.3/barrel from the average in April.

Also, the front-month futures price for Brent crude oil settled at $41.73/barrel on June 10, an increase of $15.3/barrel from May 1, 2020.

Meanwhile, the front-month futures price for West Texas Intermediate increased by $12.1/barrel over the same period to settle at $36.6/b on June 4.

Reflecting the gradual price recovery and expected switch in market balance to a deficit starting June.

In the report, NOVA stated that economic reopening will spur crude oil demand.

With the gradual reopening of some economies, crude oil demand rebounded in May by 3.72 mbpd, largely above consensus estimate.

In its June short-term energy outlook, the EIA expects a switch in market fundamentals to a deficit of 1.89 mbpd in June, with a wider deficit of 3.9 mbpd in July to kick start Q3 on a good note.

Notwithstanding, the Covid-19 associated shutdown will still keep global oil consumption lower by 8.2 mbpd in 2020 to average 92.5 mbpd from 100.7 mbpd in 2019, analysts stated.

Analysts said consumption in OECD is expected to decline by 5.2 mbpd, and by 2.99 mbpd in Non-OECD in 2020.

In the OECD region, the decline is dominated by the US (-2.4 mbpd to average 18.1 mbpd) and Europe (-1.51 mbpd to average 12.6 mbpd).

Also, Canada, Japan and Other OECD are expected to record declines in demand by 1.33 mbpd to average 11.4 mbpd in 2020 compared to 12.7 mbpd in 2019.

For the non-OECD, demand in China is expected to decline by 879 kbpd in 2020 despite ongoing stabilization.

“With confluence of voluntary and involuntary production cuts delivering decline in production by 11.06 mbpd in May,

“…we expect increased compliance by OPEC+ members who had significant shortfalls and production management by OECD producers to drive further moderation of supply in June”, NOVA stated.

Going by EIA estimates, production is estimated to decline by additional 2.02 mbpd in June.

EIA now expects a steeper decline in crude oil production among non-OPEC members by 2.54 mbpd over 2020 to 63.43 mbpd, falling below 60.3 mbpd in June.

The largest declines are expected in Russia (-979 kbpd to 10.5 mbpd), the United States (-872 kbpd to 18.58 mbpd) and Canada (-410 kbpd to 5.09 mbpd).

Overall, total world supply is expected to fall to a low of 87.56 mbpd in June, which is a 13.1 mbpd decline from April production level.

NOVA said gradual opening of key economies, minimal infection rate across could result in a rebound in oil demand with further upside potential for prices.

However, an escalation of COVID-19 beyond Q2 could further worsen the outlook for crude oil demand and a free-fall in prices.

However, the Bank sees resumption of production in Libya and Venezuela as a downside risk, as this could add additional 1.7 mbpd to current output.

Supply Cut: OPEC Records 82% Compliance, EIA Sees Uptick in Brent Price