PFAs Double Down Funding Banks’ Balance Sheets

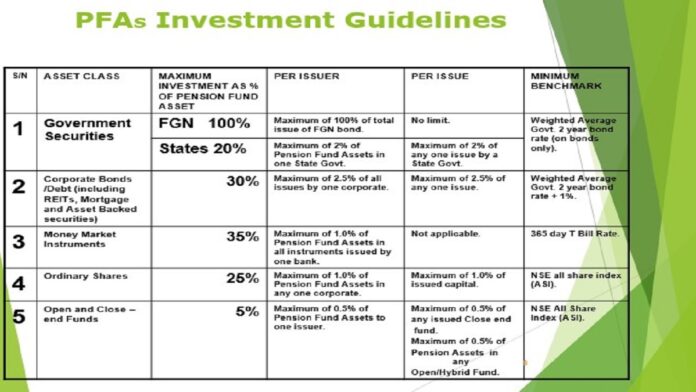

Pension Fund Administrators (PFAs) have raised their risks appetite in a stark deviation from taking positions in risk-free instruments to funding banks’ balance sheets and betting large in the equity market.

There was a more than 51% increase in bank placements to N2.24 trillion in 12-month, from N1.48 billion as pension assets expanded to N13.61 trillion in January 2022.

The funds move, according to some analysts that speak with MarketForces Africa is as a result of the need to provide a better return on pension assets amidst a double-digit headline inflation rate that has watered down naira assets.

Investment returns from the fixed income market have remained largely unimpressive with real negative yield widening despite a falling local currency – thus limiting purchasing power of maturing naira assets.

“It makes no investment sense if the pension payment receivables cannot cover basic needs of pensioners – and that’s where we are going given worsening naira outlook and steep inflation”, an asset manager who prefers not to be mentioned told MarketForces Africa.

In a recent report, the National Pension Commission (NPC) revealed that the net value of pension assets rose by 10.64% to hit N13.61 trillion as of January 31, 2022, from N12.30 trillion as of January 31, 2021.

In a review by Cowry Asset Management Limited, it was noted that a sizable chunk of the pension fund assets was invested in FGN securities. Instead, fund managers increase their investments in bank placements amid low yielding treasury bills instrument. In 2022, treasury bills auction conducted by the Central Bank of Nigeria (CBN) has seen spot rates declining.

In the report published by PENCOM, it was noted that the share of FGN Securities to total assets moderated to 61.35% (or N8.35 trillion) in the period, from 65.92% (or N8.11 trillion) it printed in January 2021.

Also, investment in Local Money Market Securities to total assets rose to 16.78% (N2.28 trillion) in January 2022, from 13.39% (N1.65 trillion) in January 2021. READ: CBN limits daily placements by banks to N2 billion

“We observed that PFAs’ investments in T-bills shrank year on year by 70.89% to N195.10 billion in 2022 from N670.34 billion recorded in 2021 as fund managers avoided low returns in that space”, Cowry Asset stated.

PFAs turned to deposit money banks to place their funds at relatively higher rates as bank placements surged to N2.24 trillion in January 2022, from N1.48 trillion in January 2021.

The firm said corporate debts securities were also patronized by fund managers, but not as strong as that of placements, given the relatively marginal increase it printed year-on-year; rising to N997.03 billion in January 2022, from N835.77 billion in January 2021.

“We note that the increased risk appetite of PFAs for Bank Placements was essentially to access better yields in the short-term as T-bills continue to trend downwards amid CBN’s strong support for economic growth.

“This is in addition to their increased participation in the equities market in 2022 amid sustained economic recovery, although still considered fragile”.

Projecting into the second quarter of 2022, Cowry Asset expects pension fund managers’ to stay invested in bank placements as the equities market may experience bearish momentum as share prices are marked-down for dividend payment. #PFAs Double Down Funding Banks’ Balance Sheets