Investors Hit Jackpot in Nigerian Exchange as Daily Gain Spikes

Equities investors in the Nigerian Exchange see the strongest daily gain in the local bourse following an improved bargain hunting in growth and value stocks. Trading results indicate the bulls extend the market’s positive sentiment to four consecutive trading days, pushing key performance indicators upward while return spikes further.

According to trading data from the domestic bourse on Wednesday, the Nigerian Exchange All-share index inched higher by 2.90%.

Stockbrokers at Atlass Portfolios Limited relate the market’s positive outturn to an increased buying across the five major market sectors, especially the Industrial sector. The industrial index expanded by 9.25% in a day, the best ever trading outing in the second half of 2022.

Year-to-date returns advanced to 8.23% while the Nigerian Exchange All-share index popped higher by 1,303.04 basis points, an increase of +2.90% to close at 46,232.37 points, according to stockbrokers’ notes.

Despite bargain hunting, stock market activities were mixed as the total volume traded for the day increased by +48.48%, while the total value traded for the day reduced by -52.17%.

Market analysts at Atlass Portfolios Limited said approximately 187.91 million units valued at ₦1,842.16 million were transacted in 3,458 deals. TRANSCORP was the most traded stock in terms of volume, accounting for 16.81% of the total volume of trades.

The conglomerate company was followed by ACCESSCORP (10.39%), ETI (7.68%), GTCO (7.32%), and ZENITH BANK (7.05%) to complete the top 5 on the volume chart.

Trading data from the domestic bourse shows that ZENITH BANK was the most traded stock in value terms, accounting for 13.90% of the total value of trades on the exchange on Wednesday.

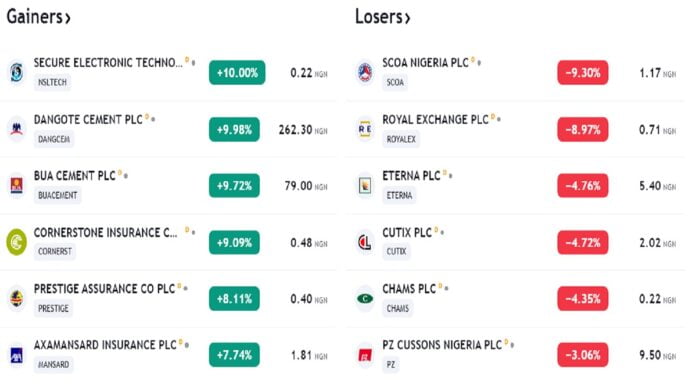

Though rare but NSLTECH topped the advancers’ chart with a price appreciation of 10.00 percent- the maximum allowable daily gain per listed company.

The company was trailed by DANGCEM which appreciated by 9.98% following a fresh 10% share buyback plan by the group. Also, BUACEMENT’s share price inched upward by 9.72%.

Still, on the gainers’ chart, CORNERST surged by 9.09% while PRESTIGE rose by 8.11% apart from twenty-two others that attracted buying interest. READ: Yield on T-Bills Spikes, Bond Slides Small as Naira Falls

NGX trading data shows that eleven stocks depreciated, topped by SCOA with a price depreciation of -9.30% to close at ₦1.17. ROYALEX lost 8.97%, and ETERNA was down by 4.76%.

Also, CUTIX fell by 4.72%, CHAMS declined by 4.35%, and PZ dropped 3.06% of its opening valuation due to selloffs on the ticker.

Overall, the market breadth closed positively, recording 28 gainers and 11 losers, though all the five major market sectors closed positively, according to Stockbrokers at Atlass Portfolios Limited

The industrial index inched upward by 9.25%, followed by the Insurance index which gained 3.66%, and the banking index improved by 1.82%. The Oil & Gas sector jumped marginally by 0.66%, and the Consumer goods index was up by 0.33%.

At the end of the trading session, the equities market capitalisation printed ₦709.73 billion gain, up by 2.90% to close at ₦25,181.53 trillion from ₦24,471.80 trillion yesterday. # Investors Hit Jackpot in Nigerian Exchange as Daily Gain Spikes