External Reserves Dip amidst Pressure to Defend Naira

Relatively higher demand for foreign currencies dragged external reserves lower by 0.2%, while the naira struggles to retain value in the Investors’ and Exporters’ FX window after it suffered massive devaluation due to spurious demand for the dollar in the black market.

The monetary authority has maintained a no devaluation policy position on the local currency while playing an intervention game at the FX market to ensure the naira holds strong.

Latest data from the CBN website indicates that Nigeria has $37.4 billion as gross external reserves covering some 10-months imports bills following despite higher crude oil prices in the global market.

At the beginning of the second half of 2022, data from the CBN indicates that gross external reserves printed at $39.173 billion – recording about $2 billion decline in four months –excluding inflows from oil exports in the period.

With a large debt profile, Nigeria has a number of maturing Eurobond repayments, though Federal Government fiscal performance weakened in the first half of the year, according to a Budget Office report.

Analysts told MarketForces Africa that the burden of debt payments will be exacerbated by weakening exchange rates, noting that Sub-Saharan (SSA) currencies have depreciated aggressively in 2022 due to monetary tightening, risk-off sentiment and high commodity prices.

The Central Bank of Nigeria (CBN) has tried to put up efforts to drive dollar inflows. However, these have not impacted the exchange rate markets – both official and unofficial.

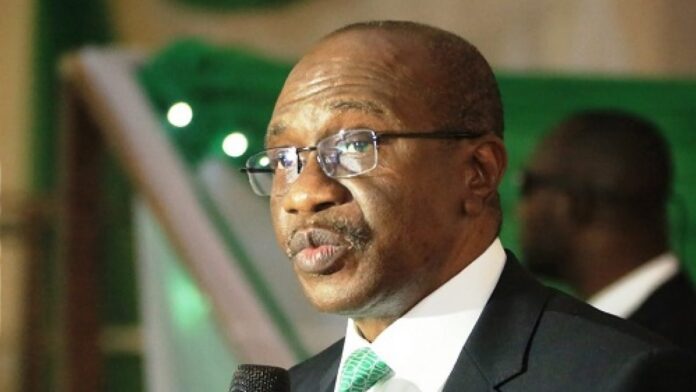

Broadstreet analysts have a single chorus: “naira is overvalued”. The apex bank also alluded to the overvaluation of the local currency, but a pro-growth economist in the person of Godwin Emefiele, the CBN Governor, has maintained his no devaluation stance while the local currency continues to bleed.

‘It is much easier to ask the CBN to devalue naira to spice up hot money inflows into Nigeria, but it comes at a cost to Nigerians that live under $2 per day in the country”, according to Julius Alagbe, economist and a financial analyst said while speaking with an investors forum in Lagos at the weekend.

Last week, there were riotous currency trading activities in the parallel market amidst a plan to redesign the naira. A large volume came from the ‘blue sky’ where it was stashed away by some criminal elements in the country.

As a result, there were pressures on exchange rates, this time, not due to allowable, and productive demand for foreign currencies but for certain individual selfish interests.

For Nigeria, the weakening currency has further inflated the cost of foreign currency debt payments. This will impact the 2023 budget amidst a record level of fiscal slippage in the country. READ: FX: CBN sells $10bn to defend Naira in fourth quarter

Down by 0.2% last week, the Nigerian Autonomous foreign exchange fixing (NAFEX) rate traded within the range of N424.0-447 per the United States dollar but closed at N445.50, according to analysts’ notes.

In the forwards market, FX traded within the range of N443.0-447 to a greenback. In the retail secondary market intervention sales (SMIS) market, the FX spot rate remained unchanged to close at N430.

In the parallel market, the Naira closed at an average of N870, thus the gap between the NAFEX and parallel market rates was above 95%, according to Coronation Research note.

Citing data from the FMDQ Exchange platform, analysts’ market reports indicated that NAFEX turnover increased by 52% or $32.2 million week on week to $94.1 million on Friday.

The NAFEX window recorded an inflow of $130 million with the CBN accounting for 9.4%, FPIs accounting for 29.5%, non-bank corporates accounting for 21.6%, exporters accounting for 35.4% and others accounting for 4.1%.

Analysts said the naira also depreciated against the Chinese Yuan (CNY), according to data from the CBN. Traders stated that the naira depreciated by -0.7% to close at N60.9 against Yuan # External Reserves Dip amidst Pressure to Defend Naira